All Categories

Featured

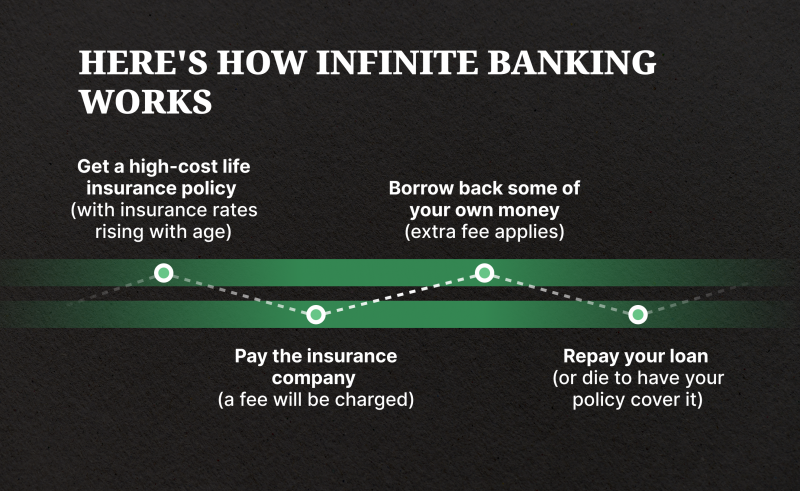

Entire life insurance policies are non-correlated possessions - Cash value leveraging. This is why they function so well as the monetary foundation of Infinite Financial. Despite what takes place out there (stock, real estate, or otherwise), your insurance plan maintains its worth. A lot of people are missing this vital volatility barrier that assists safeguard and grow riches, rather breaking their cash right into two pails: savings account and investments.

Market-based financial investments grow riches much faster yet are subjected to market variations, making them inherently high-risk. Entire life insurance is that 3rd pail. Cash flow banking. Leverage life insurance.

Latest Posts

Infinite Banking Concept And Cash Value Life Insurance

Infinite Banking Nelson Nash

Infinite Banking Center